Australian Flexible Office Market Report 2024

Analysis of tenant preferences reveals a strong inclination toward premium amenities, convenient locations, and technologically advanced spaces. The Australian flexible office market exhibits diverse regional dynamics, with Sydney maintaining its position as a leading spot despite a slight dip in demand. At the same time, Melbourne underwent a pricing adjustment amidst higher flexible office vacancy rates.

Brisbane demonstrated stability in the flexible office market, and Perth showed signs of softening. Canberra and Adelaide presented themselves as cost-competitive options for flexible offices in Australia. Although specific data on the overall inquiry-to-deal ratio remains elusive, the market caters to many startups, SMEs, and established corporations embracing hybrid work.

Looking ahead, the Australian flexible workspace market is projected for continued expansion, driven by ongoing trends such as the flight to quality, increased landlord participation, and a growing emphasis on sustainability.

The Rise of Flexible Workspaces in Australia

Shifting Away from Traditional Office Models

Australia's work landscape has significantly transformed, with a notable move away from traditional, long-term office leases towards more flexible solutions. The COVID-19 pandemic acted as a powerful catalyst in this evolution, accelerating a trend that was already gaining momentum.

Australian Bureau of Statistics data in August 2024 indicated that 36% of employees regularly worked from home. While this figure represents a slight decrease from the peaks of 37% in 2023 and 40% in 2021, it remains considerably higher than the pre-pandemic levels, which hovered around 30-32%.

This sustained prevalence of remote and hybrid work arrangements underscores a fundamental change in how businesses and individuals approach their work, creating a consistent demand for alternatives to conventional office setups.

Beyond the shift in work location, businesses are expressing increasing dissatisfaction with the constraints and costs associated with traditional office spaces. Many organisations are actively optimising their spatial requirements, often finding that they need less office space than they did in the pre-COVID era.

This trend reflects a growing emphasis on efficiency and cost-effectiveness, where companies only pay for the workspace and amenities they need. Flexible workspaces, with their varied membership models and scalable options, align perfectly with this desire for agility and the avoidance of underutilised, expensive traditional office leases.

It is also important to note that the demand for workplace flexibility is not a recent phenomenon but has been steadily increasing since 2015. The pandemic amplified and solidified this preference, suggesting a deep-seated, long-term shift in workplace desires rather than a temporary response to external events.

Key Drivers for Choosing Flexible Workspaces

The increasing popularity of flexible workspaces in Australia in 2024 can be attributed to a confluence of compelling factors that cater to the evolving needs of both businesses and individuals.

Flexibility and control stand out as primary drivers, with coworking spaces offering greater control over time, schedules, and budgets. The rise of hybrid work models has further increased the need for flexibility, demanding that individuals and organisations have adaptable solutions for where and how they work.

Another significant advantage offered by flexible workspaces is cost-effectiveness. Membership fees provide a manageable way for businesses to operate and expand as their needs evolve. Compared to the substantial capital expenditure and long-term commitments associated with traditional office leases, flexible office spaces offer considerable cost savings.

The amenities and perks provided by many flexible workspaces also play an essential role in their appeal. These flex spaces often include valuable extras such as on-site gyms, wellness studios, concierge services, and high-speed unlimited Wi-Fi. Notably, there is a growing demand for even more sophisticated, luxurious, and high-quality amenities in these workspaces, reflecting a desire for an enhanced work experience.

For many, the opportunity for networking and collaboration is a key draw. Coworking environments naturally boost interaction among a diverse range of professionals, providing valuable opportunities for inspiration, the exchange of ideas, and the growth of professional networks through both formal and informal community events. The sense of community and belonging these spaces cultivate is also a significant benefit for individuals seeking connection and a supportive work environment.

Location and convenience are also paramount. Flexible workspaces, including those strategically located in suburban areas, can significantly reduce commute times and offer convenient access to amenities and transport links. The increasing adoption of the '15-minute city' concept, where people aim to live and work within a short distance, further fuels the demand for flexible workspaces closer to home.

Access to essential technology and support is another key consideration. Flexible workspace memberships often include high-speed Wi-Fi, business-grade printers, and readily available IT support. The market is also seeing the emergence of more technologically advanced spaces incorporating user-centric features.

Beyond individual and business needs, companies recognise the strategic value of flexible workspaces in recruitment and talent retention. Offering access to high-quality flexible workspaces can be an attractive perk for employees, helping companies to attract and retain top talent in a competitive market.

The evolving relationship between landlords and flexible workspace operators is also shaping the market. Commercial landlords are increasingly becoming clients themselves, seeking high-quality third spaces within their buildings for their tenants or even operating their flexible workspace offerings.

Finally, ethical considerations are playing a growing role in workspace selection. Companies are looking for ethical workspaces that align with their environmental, social, and governance (ESG) targets, including a focus on sustainability.

The Growing Importance of Sustainability

Sustainability is another significant consideration within the flexible workspace market in Australia in 2024. It is no longer a peripheral concern but a central topic of discussion, influencing the choices of both operators and tenants.

Eco-conscious coworking spaces prioritising sustainability are gaining a distinct advantage, attracting talented and socially aware individuals who are increasingly factoring environmental impact into their decisions. This trend is particularly evident in the Asia Pacific region, where interest in green-certified workspaces experienced a remarkable surge of 500% in late 2024.

This significant increase underscores a growing demand for environmentally responsible workspace options, presenting a clear opportunity for flexible workspace providers who actively integrate sustainable practices into their offerings.

2024 Supply of Flexible Offices in Australia

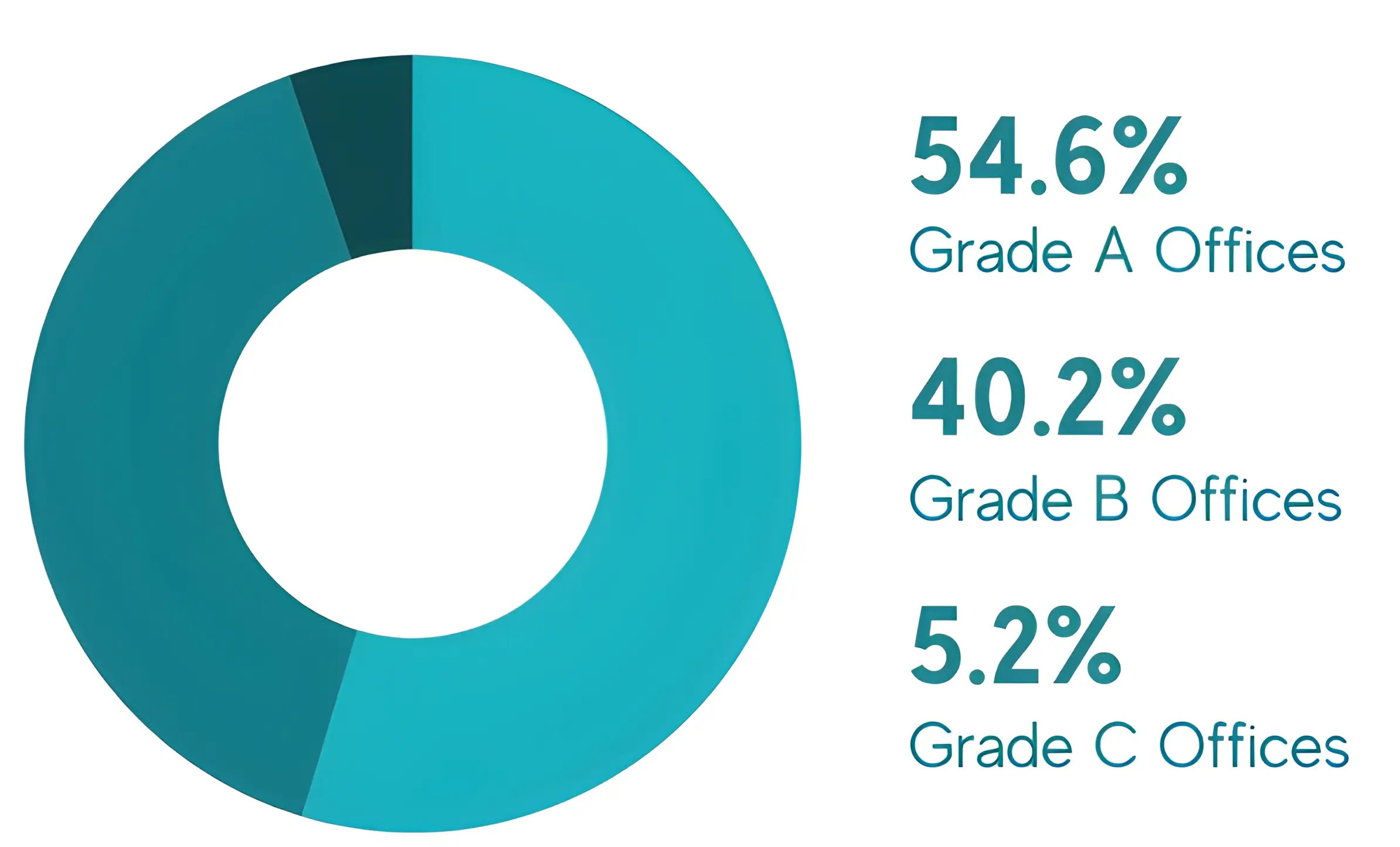

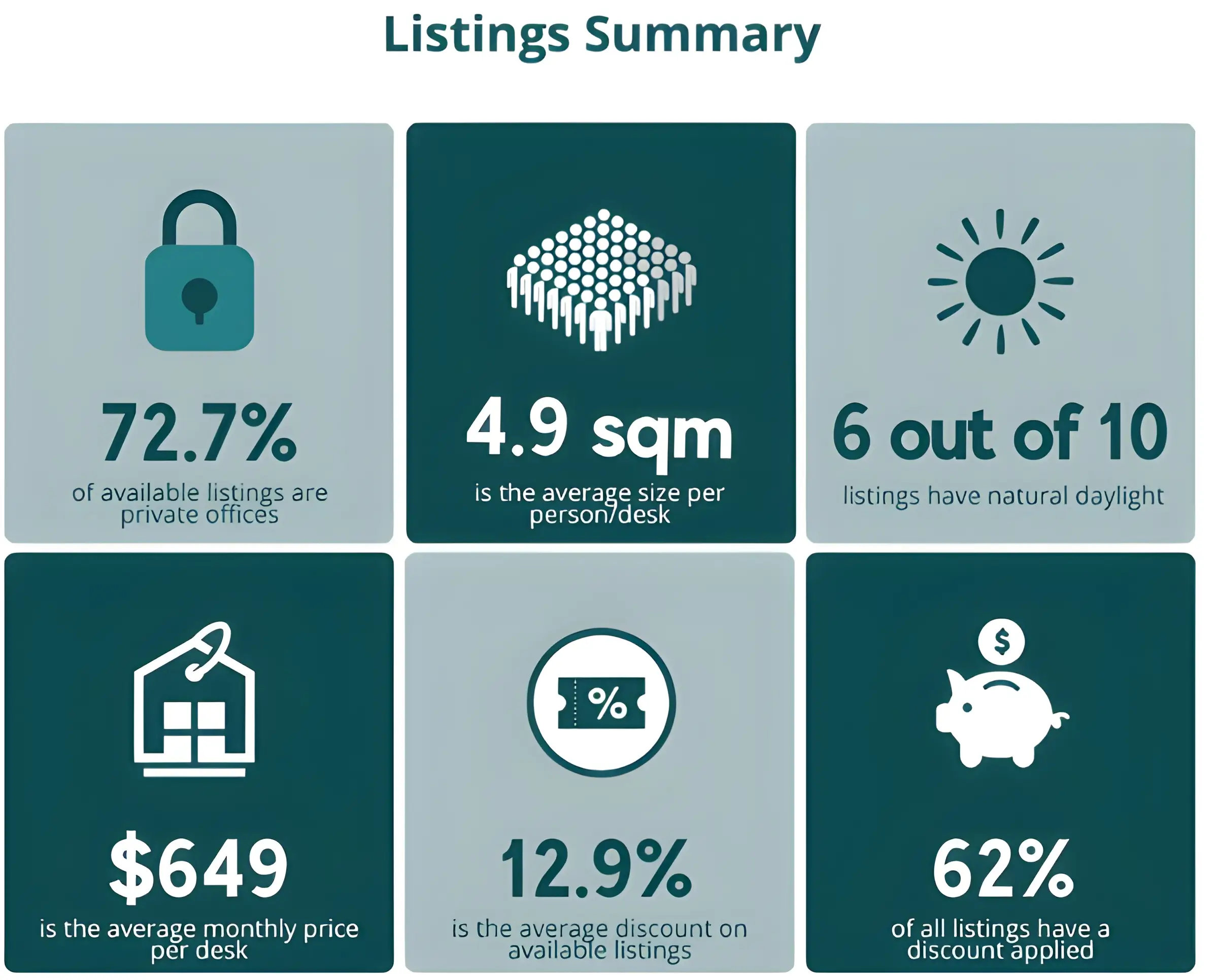

In 2024, Australia’s flexible office market underwent significant changes in supply dynamics. Grade A flexible offices accounted for the largest share at 66.3%, followed by Grade B workspaces, which represented 29.6%. In contrast, only a few providers continued offering Grade C flexible offices, making up just 3.1% of the market.

Grade A flexible offices, typically in central business districts (CBDs), have seen a surge in offerings. Landlords are increasingly adopting management agreements to integrate flexible spaces within these high-quality buildings, aiming to attract tenants seeking premium amenities and locations.

Meanwhile, Grade B and C flexible offices are more cost-effective and traditionally have a mix of serviced and coworking spaces. However, there is a growing need for modernisation to meet contemporary tenant expectations. For instance, Melbourne requires an estimated AUD 5.2 billion to upgrade 1.8 million square meters of office space to prevent obsolescence. (The Australian).

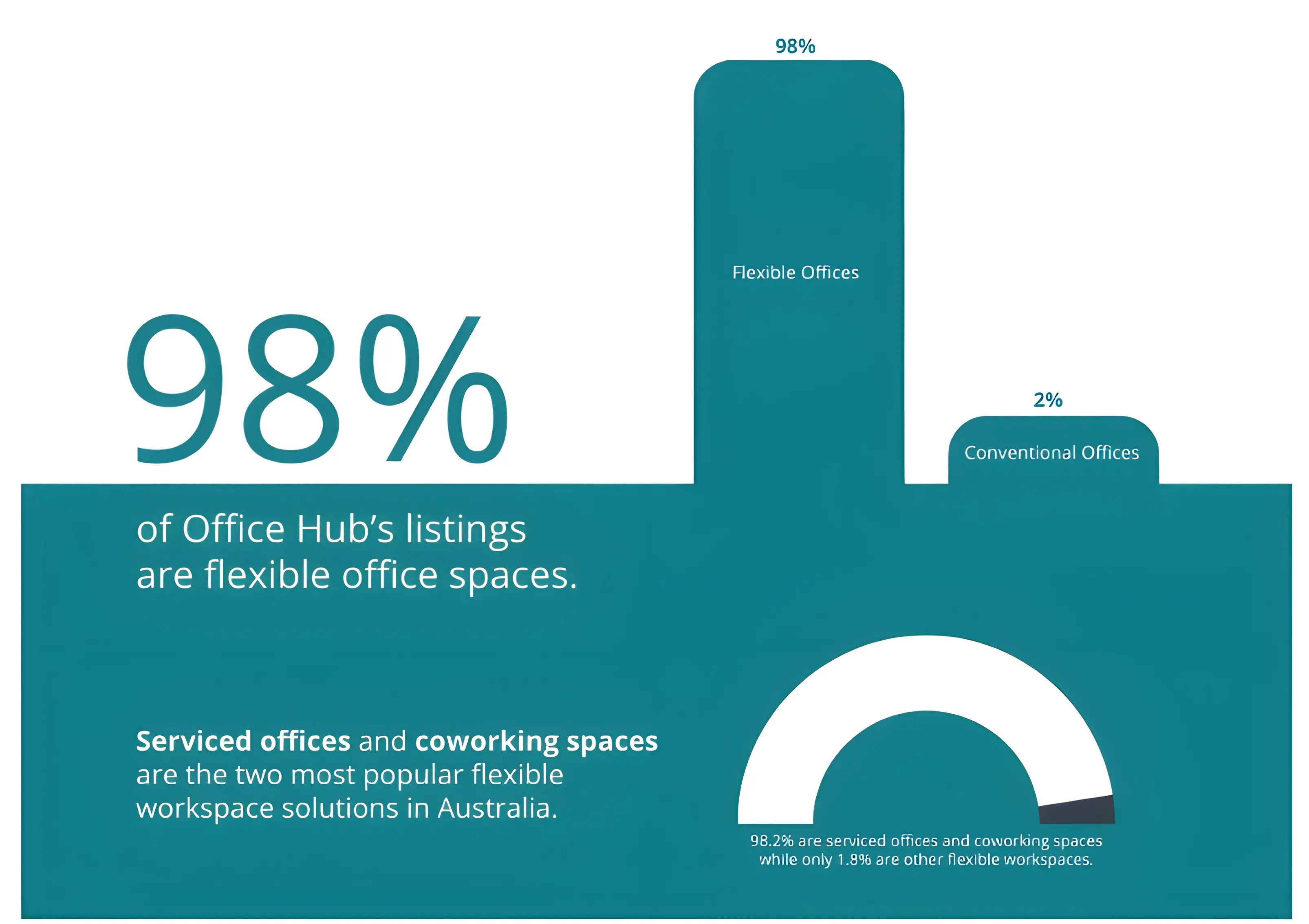

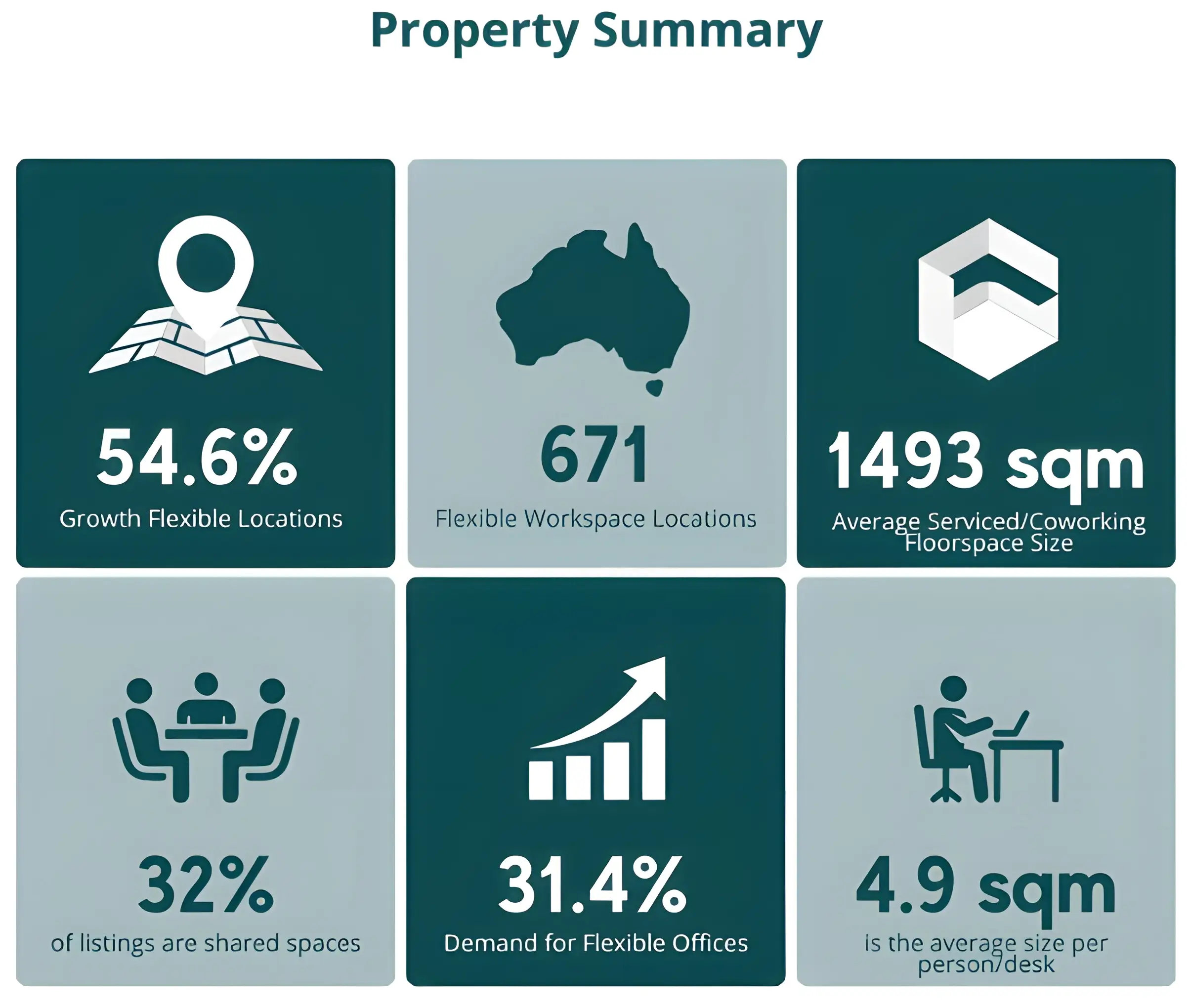

Prevalence and Average Floor Space Size

Serviced and coworking spaces have emerged as the dominant type within the flexible office market, especially in major cities like Sydney and Melbourne. These spaces cater to a diverse clientele, including freelancers, startups, and established companies seeking satellite offices. The average floor space size for coworking environments varies, ranging around 1493 sqm.

Supply Trends Over Recent Years

The supply of flexible office spaces in Australia has experienced fluctuations.

- Growth Trends: Post-pandemic recovery has led to a resurgence in demand for flexible workspaces. International operators now view Australia as a mature market with growth potential, prompting some to actively explore opportunities, particularly in prime-grade buildings.

- Supply Adjustments: Supply has been recalibrated in response to evolving demand patterns. For example, Rubberdesk reported that Sydney's flexible office market experienced a 3% contraction in inventory, totaling 33,810 square meters in Q3 2024.

This reduction, especially a 6% decline in spaces designed for 16 or more desks, indicates a market shift towards smaller, more adaptable office solutions.

Desk pricing within flexible workspaces has seen variations across cities and workspace types:

- Sydney: According to Savills, median desk rates in Sydney rose by 7% in 2024, reaching approximately AUD 1,000 per desk. Premium locations, such as Barangaroo, command rates of up to AUD 1,300 per desk, reflecting the high demand and limited supply in these regions.

- Melbourne: Median rates range from AUD 688 for offices accommodating 1 to 4 people to AUD 836 per person for larger private offices designed for teams of 16 to 25 staff.

2024 Demand for Flexible Offices in Australia

Australia's demand for flexible office spaces has been significant, showing notable variations across cities. Despite a slight slowdown, the Australian Property Journal reported that Sydney continues to lead in flexible office space demand in the Asia-Pacific region. In contrast, The Instant Group noted that Melbourne experienced a 9% year-over-year decline in demand, indicating a more subdued market.

Preferred Workspace Types

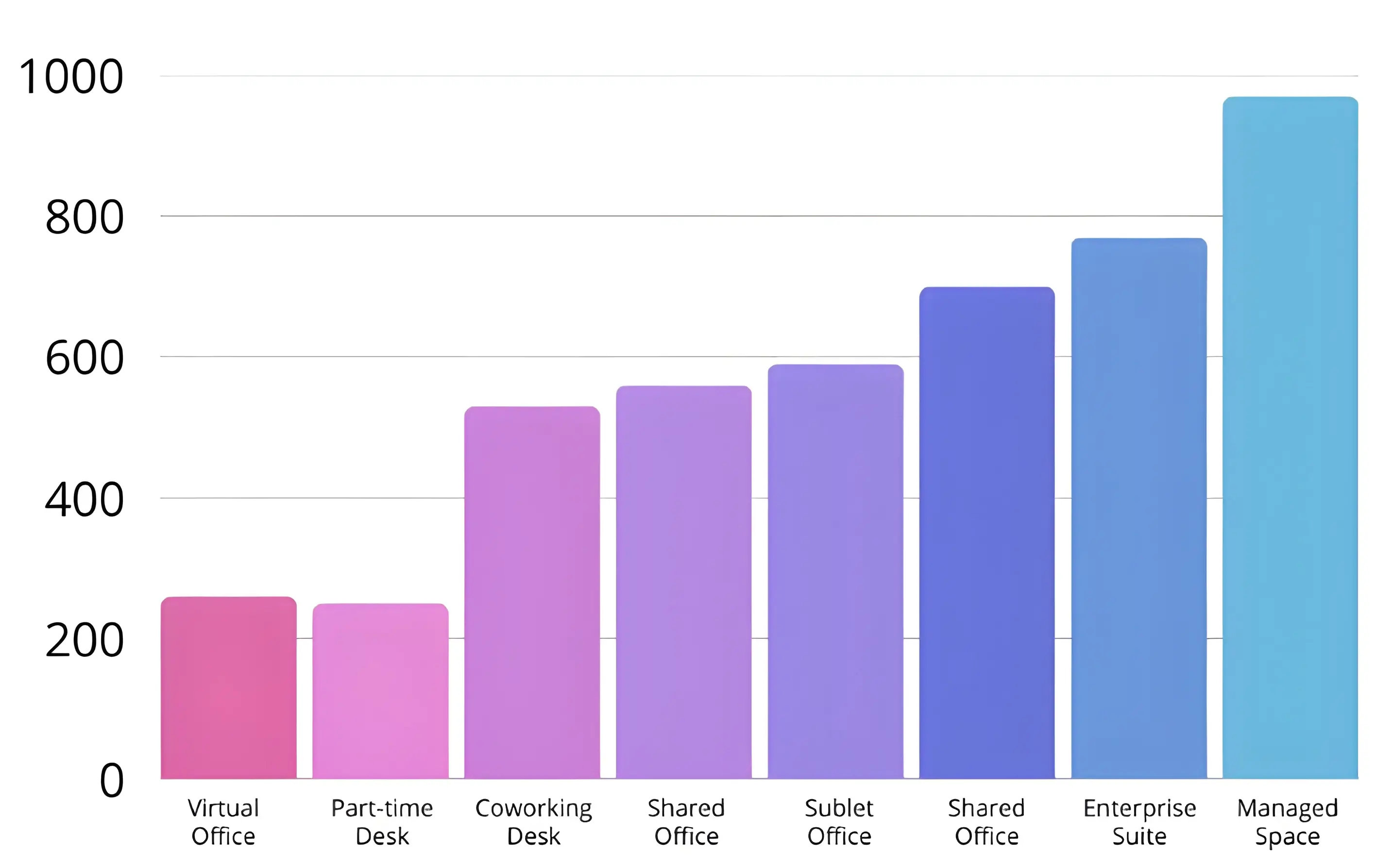

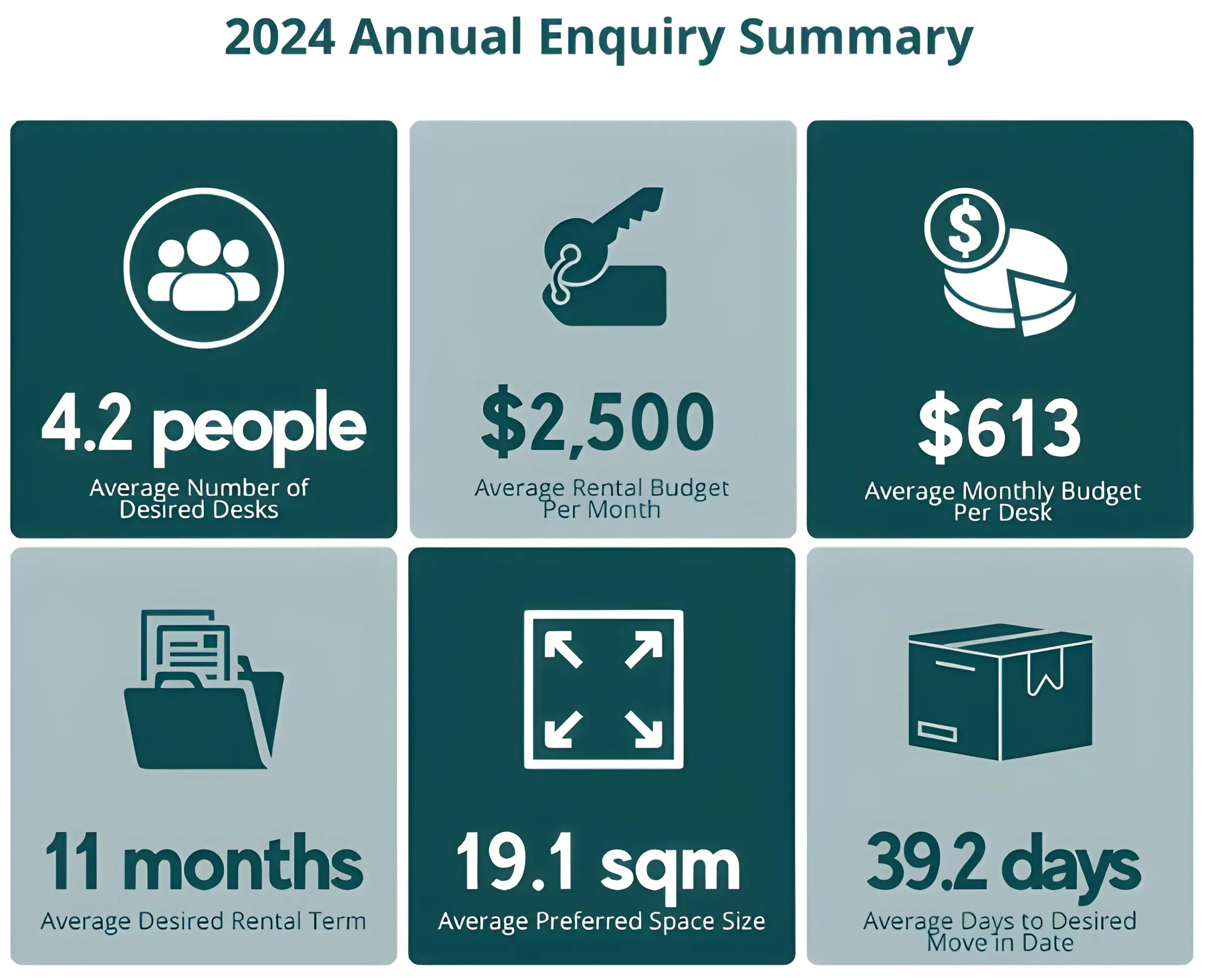

Demand for smaller office spaces, particularly those under 500 square meters, has increased. In 2024, Tenant CS reported that most office leasing activities involved suites smaller than 300 square meters, accounting for approximately 75.86% of transactions in the sub-500 square meter category. This trend underscores a preference for more compact, flexible work environments.

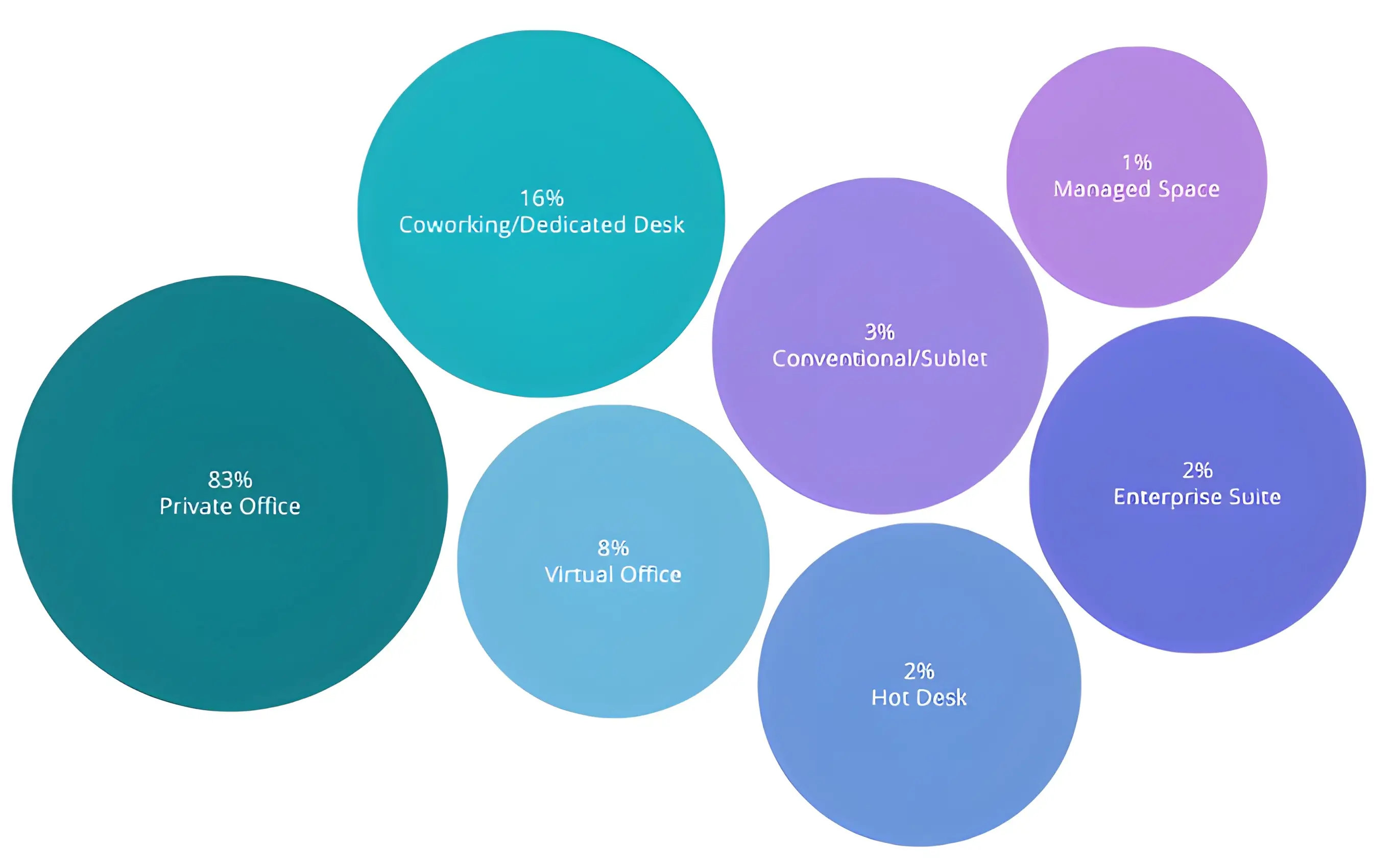

Moreover, Office Hub's 2024 data indicated that private offices are the most sought-after option for businesses and professionals, closely followed by coworking desk alternatives.

Inquiry Trends and Conversion Rates

Specific data on inquiry volumes and conversion rates for flexible office spaces in 2024 are limited. However, the sustained demand for smaller office spaces suggests high interest and successful conversions in this segment.

Occupancy Rates and Leasing Patterns

Occupancy rates for flexible office spaces remain strong, particularly for smaller suites. According to Tenant CS, the increased demand for sub-500 square meter spaces has resulted in higher occupancy levels. Leasing rates show resilience, with smaller office spaces experiencing stable or increased rates due to heightened demand.

Motivation to Move

Specific Demands in Flexible Offices

Occupiers of flexible office spaces have specific requirements, including:

- Sustainability: There is a growing demand for workspaces incorporating sustainable practices and environmentally friendly designs.

- Niche-Specific Spaces: Businesses seek workspaces tailored to their industry needs, offering specialised amenities and environments conducive to their operations.

Must-Have Features and Facilities in Australian Flexible Workspaces

The expectations of individuals and businesses using flexible workspaces in Australia have evolved, making certain features and facilities essential for a productive and positive work environment.

Core Essentials

The core essentials that support fundamental work functions form the foundation of any successful flexible workspace. These include ergonomic designs for comfort and productivity, along with various desk options like hot desks for flexible use and dedicated desks for those who prefer a permanent spot.

In today's connected world, reliable and secure Wi-Fi is non-negotiable, and access to well-equipped meeting rooms and private offices is mandatory for confidential discussions and collaborative sessions. Convenient printing and scanning facilities remain necessary for many users.

The Shift Towards "Hyper-Amenity"

The Australian flexible workspace market in 2024 witnessed a notable shift beyond standard amenities towards what can be termed "hyper-amenity". Basic offerings are no longer sufficient to meet the evolving expectations of tenants.

Instead, there is a growing demand for workspaces that provide more than just administrative support, encompassing a broader array of facilities aimed at holistic well-being and lifestyle integration. This includes wellness spaces and yoga rooms to enhance physical and mental health, versatile event spaces for hosting gatherings and workshops, and even specialised areas like podcast studios to meet the needs of content creators.

This trend underscores the increasing need for flexible workspace providers to differentiate themselves by offering a richer and more comprehensive suite of amenities that cater to a broader spectrum of user needs and preferences.

Regional Breakdown of the Australian Flexible Workspace Market in 2024

The Australian flexible workspace market in 2024 exhibited distinct characteristics across its major cities, reflecting varying economic conditions, demand patterns, and supply dynamics.

Sydney

Savills reported that Sydney retained its status as a leading market for flexible workspace in Australia throughout 2024. Median desk rates in Sydney's flexible market rose by approximately 7% during the year, driven by a tightening of supply, especially for flexible suites accommodating fewer than 15 desks.

The median desk rate in Sydney reached approximately AUD$1,000, with premium locations like Barangaroo commanding rates as high as AUD$1,300 per desk. Conversely, the supply of larger flex spaces, those with 16 desks or more, experienced a decline. Interestingly, Sydney's overall demand for coworking and flex space inquiries decreased slightly, showing a 10% decline compared to the previous year.

Occupancy rates in Sydney's predominant flex centres remained healthy, hovering between 70% and 80%. In terms of market share, WeWork continued to be the largest operator in Sydney, boasting approximately 9,000 desks across the city.

The Sydney CBD Core remained the most sought-after location for flexible workspace, attracting businesses due to its accessibility, amenities, and transport links. Despite a slight dip in overall inquiries, the resilience of high desk rates in Sydney suggests continued strong demand for smaller teams seeking premium locations.

Melbourne

The flexible workspace market in Melbourne presented a different picture in 2024, characterised by a pricing adjustment amid higher vacancy rates. In the third quarter of 2024, Rubberdesk reported that desk rates in Melbourne fell by 2.4% compared to the previous quarter, reaching AUD $725 per desk, which is 7% below the peak in the first quarter.

By the fourth quarter, desk rates were reported to be $700. This downward pressure on pricing occurred against a backdrop of rising vacancy rates in Melbourne's commercial real estate sector, which approached 20%.

The overall supply of flexible office space in Melbourne decreased by 4.7% in the third quarter but rose significantly by 15% since the second quarter, reaching 37,320 sqm in the fourth quarter. Pricing trends varied based on office size.

While rates for smaller offices accommodating 1 to 15 staff saw a 6% decline in the third quarter, mid-sized spaces for teams of 16 to 50 people experienced an 8% increase. In the fourth quarter, median rates in Melbourne ranged from $688 for 1-4 person offices to $836 per person for private offices accommodating 16-25 staff.

In the suburban markets of Melbourne, Richmond held its status as the premium location with a desk rate of $800 in the third quarter, a rate that remained stable into the fourth quarter. The decreasing desk rates and high vacancy in Melbourne indicate a more competitive market, possibly providing more favorable terms for tenants.

Brisbane

The Brisbane flexible workspace market displayed relative stability in 2024. In the fourth quarter of 2024, Rubberdesk reported that desk rates across Brisbane remained constant at $600 per desk per month, consistent with the city's historical average.

However, another source reported rates of $700 during the same period. Brisbane's supply of flexible office inventory grew by 14% in the fourth quarter, reaching 14,135 sqm, following two consecutive quarterly increases driven by new inventory from operators.

The median price for flexible office space in inner Brisbane varied by office size, ranging from $297 per person for offices accommodating 50 or more desks to $706 per person for mid-sized offices accommodating 11 to 15 desks. While there was ample supply for smaller teams of up to 15 people, options for larger teams exceeding 25 were limited outside the Brisbane CBD.

The steady desk rates and increasing inventory in Brisbane indicate a balanced and healthy market, with a potential opportunity for providers to cater to the underserved larger team segment in suburban areas.

Perth

Perth's flexible workspace market showed signs of softening in 2024. After reaching a peak of $735 per desk in 2023, Rubberdesk found that the desk rate for flexible office space across Greater Perth fell by another 7% in the fourth quarter of 2024, settling at $649 per desk. However, another report indicated that rates were at $700.

Following a decline in inventory earlier this year, the availability of flexible office space in Perth increased significantly by 27% in the fourth quarter, reaching 6,120 sqm. While the median desk rate in the Perth CBD was $749, which is comparable to CBD prices in other major cities- especially for smaller teams- space for larger teams of 16 or more desks was attractively priced at $649 per desk.

Interestingly, private offices comprised the majority of flexible space rented in Perth, accounting for 85%. For businesses with tighter budgets, West Perth provided better value for smaller teams compared to the CBD. The declining desk rates and increasing supply in Perth indicate a more competitive environment, offering more cost-effective options for tenants.

Canberra

Canberra's flexible workspace market in 2024 emerged as a more affordable option compared to other major Australian cities. Rubberdesk reported that the median office rate per person in the Australian Capital Territory (ACT) was $500 per desk per month in the fourth quarter of 2024, significantly lower than the national median of $652 per desk.

Another source reported a slight increase to $510. The median coworking desk rate per person was even lower at $360 per desk per month. Available office space in Canberra experienced a fourth consecutive quarterly decline, falling by 6% to 4,505 sqm in the third quarter (fourth-quarter data was not provided in the snippets).

The market in Canberra primarily catered to smaller teams, with 85% of all available offices and 56% of available space allocated for teams of up to ten people. For companies seeking more budget-friendly options, suburbs outside the CBD provided a variety of smaller offices for teams of 10 or fewer individuals at a median rate of $540 or less per desk. The lower desk rates and emphasis on smaller team sizes make Canberra an appealing market for startups and small businesses.

Adelaide

In 2024, Adelaide's flexible office market presented some of the most affordable options in the country. After stabilising at $600 per desk in the first half of the year, Rubberdesk reported that the desk rates in Adelaide sharply dropped to $459 per desk in the fourth quarter, largely due to slower demand.

However, another source indicated that rates remained unchanged at $600. Following a significant 50% drop in the first three quarters of the year, the supply of flexible office space in Adelaide regained some ground, jumping by 33% in the fourth quarter to 2,460 sqm.

Median prices for flexible office space in Adelaide varied by office size, ranging from $385 per person for teams of 26 to 50 members to $725 per person for teams of 16 to 25 members. Similar to Canberra, the Adelaide market predominantly catered to small teams, with 96% of all available offices and 82% of the available space designed for teams of up to ten individuals.

Options for larger teams of 26 or more were minimal. For businesses not needing a CBD location, suburbs offered more affordable options, starting at $356 per desk in Mawson Lakes. The significant decrease in desk rates positions Adelaide as a highly cost-competitive market, primarily focused on serving the needs of small businesses and startups.

Inquiry-to-Deal Summary for the Australian Flexible Workspace Market (2024)

The inquiry-to-deal ratio in 2024 reflects Australia's dynamic yet competitive flexible office market. This year, the conversion rate from initial inquiry to a signed agreement has seen slight improvements compared to previous years, signaling growing confidence in flexible workspaces. On average, an inquiry takes 20 days to convert into a deal, while the time from a signed contract to actual move-in is 18 days.

The average team size opting for flexible offices remains consistent at four employees per deal, with contract values varying based on location and workspace type. Lease durations have averaged 8.3 months, while the monthly desk rate across different classifications (serviced, coworking, and managed offices) sits at $555 per desk. The most sought-after properties in 2024 predominantly feature premium amenities and hybrid working solutions, with the majority of users being startups, SMEs, and corporate teams looking for short-term flexibility.

Most Sought-After Property and Workspace Types

In 2024, the most sought-after property type for flexible workspaces in Australia continued to be prime and A-grade buildings in central business districts. These locations offer superior amenities, excellent transport links, and a prestigious business address. However, suburban locations are also gaining traction as businesses and individuals seek workspaces closer to their homes, aligning with the '15-minute city' concept.

In 2024, hybrid flex-space was the most sought-after workspace type in the Australian flexible workspace market. This model effectively combines the benefits of traditional coworking with the services and privacy of serviced offices and represented approximately 61% of the National CBD market.

This dominance indicates a strong preference for workspaces that offer a mix of open collaborative areas, private office options, and a comprehensive suite of business support services. Demand for dedicated private offices and well-equipped meeting rooms also remained high.

Typical Users

The profile of the typical user of flexible workspaces in Australia continued to broaden in 2024. While freelancers and startups remain key segments, established companies and larger enterprises are increasingly adopting flexible workspace solutions.

Corporations and technology startups utilise flexible spaces to create smaller, more agile headquarters as they embrace hybrid working models. Small and medium-sized enterprises (SMEs) also constitute a significant user base.

Furthermore, the market continues to cater to remote workers, digital nomads, and entrepreneurs who value these spaces' flexibility, community, and networking opportunities.

This diversification of users underscores the growing mainstream acceptance and adaptability of flexible workspaces across various industries and business sizes.

Challenges & Future Outlook

Key Challenges Facing the Australian Flexible Workspace Market

Despite its growth, the flexible workspace sector in Australia faces several challenges.

- Macroeconomic Pressures: Rising interest rates, inflation, and economic uncertainty have affected business confidence and leasing decisions, potentially hindering demand growth.

- Operator Profitability Concerns: Some flexible workspace providers, especially smaller operators, face financial pressures due to high operating costs and fluctuating occupancy rates. Operators reliant on aggressive expansion strategies may struggle to maintain profitability.

- Landlord-Operator Tensions: As landlords enter the flexible space market directly, competition between traditional landlords and third-party operators intensifies. Revenue-sharing agreements and lease negotiations require careful structuring to ensure profitability for both parties.

- Evolving Corporate Demand: While hybrid work models drive demand, some companies are still refining their long-term office strategies. This uncertainty makes it difficult for workspace providers to forecast occupancy trends accurately.

- Regulatory and Compliance Risks: Changes in zoning laws, commercial leasing regulations, and workplace safety standards could impact the operational flexibility of shared office providers.

Future Growth Projections & Opportunities

Despite these challenges, the Australian flexible workspace market is poised for steady expansion due to several key drivers:

- Enterprise Adoption of Flex Spaces: Large corporations are increasingly integrating flexible office solutions into their real estate strategies, either through satellite office models, hub-and-spoke setups, or managed office solutions.

- Growing Demand in Secondary Cities: While Sydney and Melbourne remain dominant, the demand for flexible workspaces in Brisbane, Perth, and Adelaide is rising as companies decentralise operations.

- Tech-Enabled Workspaces: The adoption of AI-driven space management, smart booking systems, and data-driven occupancy insights is making flexible workspaces more efficient and attractive to tenants.

- Sustainability Initiatives: Green-certified flexible offices with energy-efficient designs and wellness-oriented amenities will see higher demand as companies align with ESG (Environmental, Social, and Governance) goals.

- Mergers & Acquisitions: The industry may witness further consolidation, with larger operators acquiring smaller, underperforming players, leading to a more stable and structured market.

Conclusion

The Australian flexible workspace market in 2024 demonstrated robust growth and a dynamic evolution, driven by fundamental shifts in work preferences and business needs. The enduring impact of the pandemic, the pursuit of cost-efficiency, and the increasing importance of employee well-being and sustainability have solidified the position of flexible workspaces as a mainstream solution. User preferences are clearly leaning toward high-quality experiences, convenient locations, and advanced technology. While regional markets exhibit unique characteristics, the overall trend points towards continued expansion and diversification. For Office Hub, these market dynamics present significant opportunities. By strategically focusing on premium offerings, expanding reach in suburban areas, highlighting sustainable options, catering to diverse user needs, and fostering partnerships, Office Hub can further solidify its position as the leading platform connecting businesses and individuals with the ideal flexible workspace solutions in Australia's thriving market.

Office Hub: Connecting Businesses with the Right Workspaces

As Australia’s leading flexible workspace marketplace, Office Hub plays a major role in helping businesses find, compare, and secure the ideal office solution. We understand that no two businesses have the same workspace needs, which is why we offer a curated selection of serviced offices, coworking spaces, and hybrid office solutions tailored to various industries and team sizes.

What We Do

Office Hub provides a seamless end-to-end service for businesses looking to explore flexible office solutions. Our platform offers:

- An Extensive Network: Access to thousands of workspaces across Australia, ranging from boutique coworking hubs to premium corporate suites.

- Tailored Workspace Matches: We assess your business size, operational needs, budget, and location preferences to recommend workspaces that align with your goals.

- Expert Negotiation & Support: Our team negotiates lease terms on your behalf, ensuring cost-effective and flexible agreements that suit your business requirements.

- Transparent Pricing & Exclusive Deals: Compare real-time pricing, exclusive discounts, and all-inclusive workspace packages without hidden costs.

Why Choose Office Hub?

With a deep understanding of market trends, tenant expectations, and workspace dynamics, Office Hub offers more than just a listing platform; we provide strategic insights to help businesses make informed leasing decisions.

Our hands-on approach and strong partnerships with workspace providers ensure a hassle-free experience in securing a workspace that supports productivity and long-term success.

As the future of work continues to evolve, finding the right office space is more essential than ever. Explore Office Hub today and unlock workspace solutions designed for the modern workforce.